Build. Validate. Replay

Open Source Multi-Asset Market Simulator

Test your trading and execution applications and strategies.

What is

QuantReplay ?

Test Your Trading Strategies in a Safe, Realistic Environment

Build confidence in your trading strategies.

QuantReplay recreates a full-market environment using a synthetic matching engine that mirrors real-world order flow, venue logic, and multi-asset behavior. Gain complete control over matching rules, market phases, latency profiles, and data playback.

Quant Replay's

Core Capabilities

Customizable Matching Engine

Simulate continuous trading & complex venue behavior

- Emulates exchange-grade matching engines with support for price-time, pro-rata, or custom rules

- Handles multi-asset order books across FX, equities, and derivatives

- Create synthetic instruments or mirror real venue logic

Market Phase Orchestration

Recreate dynamic market environments

- Simulate continuous trading, auctions, pre-open, post-close, and volatility halts

- Define custom sequences of market phases

- Trigger transitions programmatically or on event-based conditions

Latency & Noise Injection

Stress-test systems under adverse conditions

- Add random order flow to simulate noise and crowd behavior

- Inject latency spikes or network delays

- Test edge-case responses like delayed acknowledgements or partial fill

Historical Market Data Replay

Backtest against real-world scenarios

- Replay multi-level historical market data from flat files or databases

- Control playback speed, sequencing, and timeline breaks

- Rewind or fast-forward to specific events or regimes

Programmatic Control via REST API

Manage and automate test workflows

- Configure market phases, latency, and instruments via API

- Trigger simulations and collect run results for regression testing

- Integrate with CI/CD pipelines for automated QA

Quant Replay is

Built for the Industry

Evaluate Strategy Performance

Traders

Backtest strategies, simulate edge cases, and refine algorithms with zero risk.

Validate Execution Logic

Developers

Test execution logic, simulate environments, and debug FIX connectivity.

De-risk System Architecture

CTOs

Prototype infrastructure, evaluate performance bottlenecks, and de-risk architecture decisions.

Reproduce Market Dynamics

Researchers

Model real-world market dynamics for research and teaching for capital markets and more particularly trading.

How

QuantReplay Works?

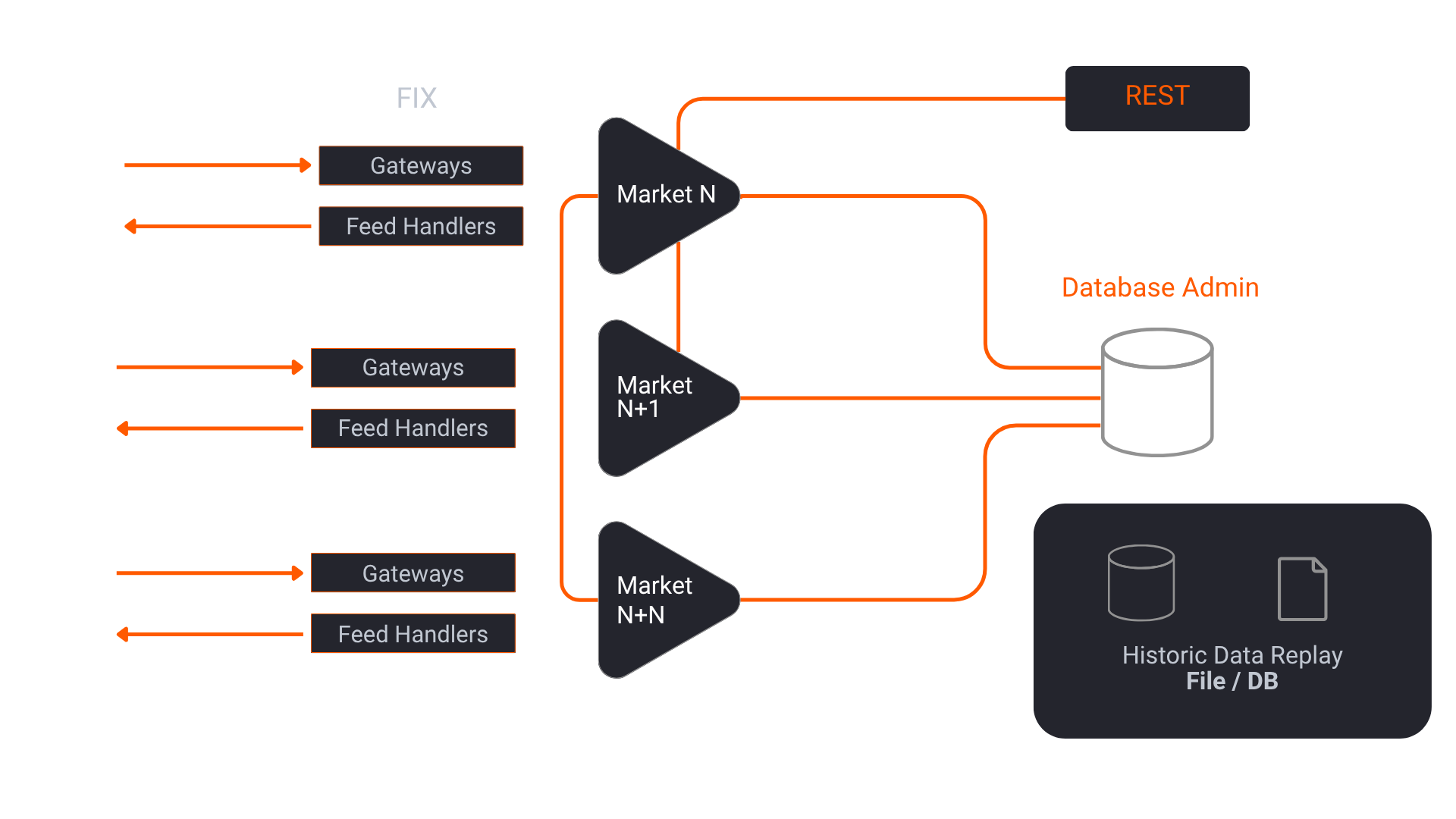

QuantReplay integrates seamlessly into your trading stack, allowing you to test trading logic by sending and receiving orders via standard FIX connections.

Operates alongside FIX Gateways and Feed Handlers

It operates alongside FIX Gateways and Feed Handlers to simulate full market interaction, while leveraging a Postgres-backed admin layer and REST API for configuration and control. Historical multi-level market data is replayed from flat files or databases, enabling realistic, high-fidelity trading scenarios in a controlled environment.

Quick Start

Run the Simulator

Launch the simulator instantly and start exploring in just one click.

Join the Community

Discover what our community is saying about their Quant Replay experience

Use cases where

QuantReplay wins

Empowers your trading strategy development and testing in several key scenarios

QuantReplay is free,

open-source software.